A comprehensive guide to ACH Payments

Whether you're paying bills online or receiving direct deposits from your employer, chances are you've encountered the term "ACH" before. But what exactly are ACH payments, and why are they important for your business? In this comprehensive guide, we'll explore ACH payments, covering everything from their basic definition to their practical applications and benefits.

Part 1: Understanding ACH Payments

What are ACH Payments?

ACH payments are a type of electronic funds transfer (EFT) initiated through the Automated Clearing House Network, a non-profit organization governing the US financial infrastructure for electronic payments. They facilitate the movement of funds directly between bank accounts, bypassing the need for cash or checks.

A Brief History

The ACH Network was established in the 1970s to streamline and automate traditional paper-based check processing. Since then, it has evolved significantly, processing trillions of dollars annually and supporting various payment types.

Who operates the ACH Network?

Nacha (National Automated Clearing House Association), acts as the governing body for the ACH Network, setting rules, standards, and security protocols to ensure smooth and secure transactions.

Setting the Standards: Nacha establishes the rules and regulations that ensure the smooth and secure operation of the ACH Network. These rules encompass crucial aspects like:

- Data formats for transmitting payment information.

- Security protocols to safeguard sensitive financial data during transactions.

- Dispute resolution processes for handling discrepancies or errors.

By establishing these standards, Nacha fosters consistency and reliability within the ACH network, benefiting participants like banks, businesses, and consumers.

Part 2: Mechanics of ACH Payments

ACH payments can be categorized as either debits or credits.

ACH Debit: Initiates a withdrawal of funds from the payer's account and deposits it into the recipient's account. (e.g., Paying bills, Online Purchases)

ACH Credit: Initiates a deposit of funds into the recipient's account from the payer's account. (e.g., Payroll, Tax refunds from the IRS)

How ACH Works:

- Initiation: The payer initiates the transaction through their bank or a third-party payment processor.

- Payer initiates: The payer (individual or business sending the money) initiates the transaction through their bank's online or mobile banking platform, or through a third-party payment processor (e.g., Stripe, PayPal).

- Information gathering: The payer enters the recipient's bank account details, including routing number and account number, along with the payment amount.

- Submission: Once confirmed, the payer submits the payment request.

- Network Processing: The payment information, including routing and account numbers, is sent through the ACH Network.

- Data encryption: The payer's bank or payment processor encrypts the payment information for security.

- Network transmission: The encrypted data is securely transmitted through the ACH Network, a central clearing house that facilitates electronic payments between banks in the United States.

- Batching: The ACH Network batches individual transactions together for efficient processing, separating ACH debits (withdrawals) from ACH credits (deposits).

- Settlement: Banks verify the information and transfer funds between accounts, typically within 1-3 business days.

- Receiving bank notification: The recipient's bank receives notification of the pending ACH transaction.

- Verification: The recipient's bank verifies the account information and ensures sufficient funds are available for debits (in the case of ACH debits).

- Funds transfer: Once verified, the ACH Network instructs the payer's bank to debit (withdraw) the funds from the payer's account and sends them to the recipient's bank.

- Crediting the recipient: The recipient's bank credits (deposits) the funds into the recipient's account.

- Notification: Both the payer and recipient typically receive notifications from their banks or payment processors confirming the successful completion of the transaction.

Part 3: Benefits of ACH Payments

Cost-Effectiveness

Significantly lower transaction fees: Compared to wire transfers, which can cost tens of dollars per transaction, ACH payments typically incur fees in the cents or low single-dollar range.

Reduced processing costs for businesses: Businesses benefit from lower processing fees compared to credit card transactions, which can have higher fees associated with chargebacks and fraud.

Savings for consumers: Individuals can save money on transaction fees by utilizing ACH payments for bills, online purchases, or sending money electronically compared to using credit cards or check cashing services.

Secure and Reliable

- Nacha-governed security standards: Nacha sets strict rules and protocols for data encryption, authentication, and fraud prevention, minimizing the risk of unauthorized access to financial information.

- Reduced risk of errors compared to checks: Unlike paper checks, which are susceptible to loss, theft, or errors, ACH payments involve electronic transfers with digital records, minimizing the possibility of human error or physical mishandling.

- Dispute resolution process: Nacha provides a well-defined dispute resolution process for resolving any issues that may arise during ACH transactions.

Efficiency and Automation

- Effortless recurring payments: ACH payments can be easily automated for recurring bills, subscriptions, or payroll deposits, eliminating the need for manual payments and saving time and effort.

- Faster processing compared to checks: While not instantaneous, ACH payments typically clear within 1-3 business days, significantly faster than the mailing and processing times associated with traditional paper checks.

- Improved cash flow management: Businesses can benefit from predictable and timely payments through ACH, allowing for better cash flow management and forecasting.

Part 4: Risks and Challenges of ACH Payments

ACH Fraud

While ACH payments are generally secure, there's always a potential for fraud if unauthorized individuals gain access to your bank account information. Here's a breakdown of the risks and mitigation strategies:

Types of ACH Fraud

- Account takeover fraud: Hackers gain access to your online banking credentials and initiate unauthorized ACH debits from your account.

- Phishing scams: Deceptive emails or phone calls trick you into revealing your bank account information, which is then used for fraudulent ACH transactions.

- Pretext calls: Scammers impersonate legitimate organizations (e.g., utility companies) and pressure you into providing your bank account information for fake payments.

Mitigating ACH Fraud

- Implement strong password protection: Use complex and unique passwords for your bank accounts and online banking platforms. Enable two-factor authentication (2FA) for an additional layer of security.

- Be cautious with unsolicited requests: Never share your bank account information via email, phone, or text message unless you can verify the legitimacy of the request by contacting the organization directly through a trusted channel.

- Monitor your bank statements regularly: Review your bank statements frequently for any unauthorized transactions and report any suspicious activity immediately to your bank.

- Beware of phishing scams: Be wary of emails or calls that pressure you to act urgently or offer deals that seem too good to be true. Don't click on suspicious links or attachments.

Common Concerns

Slower processing times: Compared to some alternative methods like cash or wire transfers, ACH payments typically require 1-3 business days to clear. This can be a concern for situations requiring immediate access to funds.

Failed transactions: Incorrect account information, insufficient funds in the payer's account, or other technical issues can cause ACH transactions to fail. This can lead to delays and potential late fees or penalties for missed payments.

Additional Considerations

- Limited international scope: ACH payments are primarily used within the United States and may not be available for international transactions.

- Dispute resolution process: While Nacha provides a dispute resolution process, resolving fraudulent transactions or errors can take time and may not always result in a full recovery of lost funds.

It's important to weigh the benefits and risks of ACH payments against other available options based on your specific needs and priorities. By being aware of the potential challenges and implementing proper security measures, you can minimize the risks associated with ACH payments and enjoy their benefits for convenient and efficient electronic funds transfers.

Part 5: Industries and Use Cases for ACH Payments

ACH payments are widely adopted across various industries:

- Payroll processing: Businesses use ACH to directly deposit salaries into employee accounts. (47% of US workers receive their pay electronically in 2023, according to the American Payroll Association)

- Bill payments: Consumers utilize ACH to pay recurring or one-time bills for utilities, subscriptions, and other services.

- Government payments: Social security benefits, tax refunds, and other government disbursements may be sent via ACH.

- Business-to-business transactions: Companies use ACH for payments between vendors, suppliers, or partners.

Part 6: How to Set Up ACH Payments

Implementing ACH payments in your business

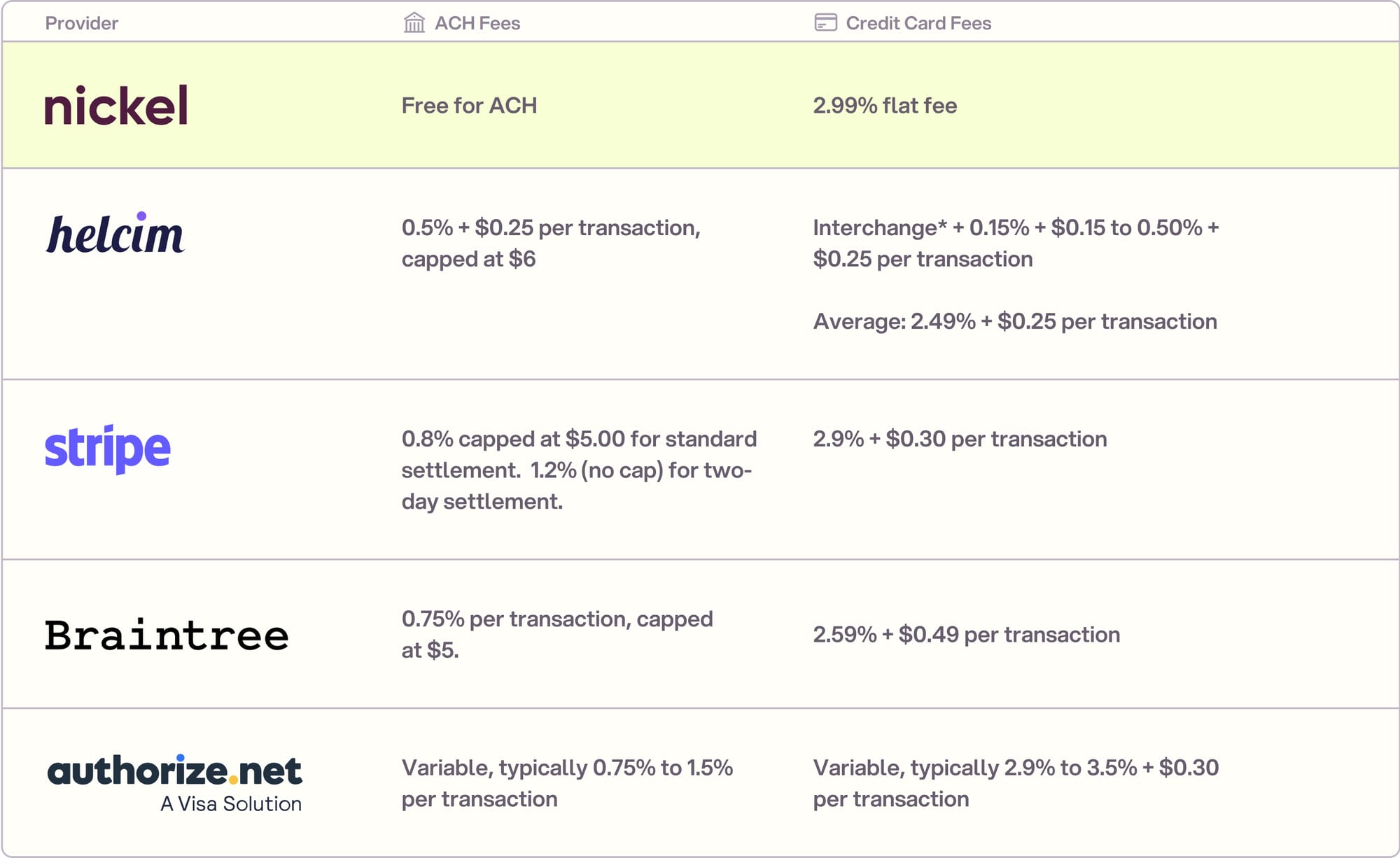

- Choose a payment processor: Select a reputable provider offering ACH processing services, considering factors like fees, features, and integration with your existing systems.

- Open a merchant account: Establish a merchant account with your chosen provider to facilitate ACH transactions.

- Collect recipient information: Gather the necessary bank account details (routing and account numbers) from your recipients.

- Initiate payments: Utilize your chosen platform to initiate ACH payments securely.

Considerations

- Compliance with Nacha rules and regulations is crucial.

- Security measures like encryption and strong authentication protocols are essential.

- Integrating ACH payments with your accounting or financial management software can enhance efficiency.

Key Takeaways

- ACH payments are electronic fund transfers facilitating secure movement of funds between bank accounts.

- They offer advantages like lower costs, security, and efficiency compared to traditional methods.

- Businesses across various sectors utilize ACH for payroll, bill payments, and other purposes.

- Implementing ACH payments requires partnering with a reliable provider and adhering to security best practices.

Comments ()